Compliance audits play a crucial role in ensuring that organizations adhere to the rules and regulations that govern their industry. Imagine a healthcare facility undergoing a compliance audit to verify that it meets the strict standards for patient care and data privacy. This audit process not only helps the organization maintain its reputation but also safeguards patient trust.

By evaluating compliance with government regulations and industry standards, these audits provide insights that drive improvements in internal controls and operational procedures.

What is a compliance audit?

A compliance audit is an external or internal assessment of whether an organization meets compliance requirements. Compliance audits assess adherence to government regulations, industry frameworks, or internal rules. Audit documentation provides regulators with evidence of compliance. And it gives audit clients the information needed to improve controls, procedures, and systems.

This article will explore the subject of compliance audits in detail. Topics covered include:

- The purpose of compliance audits

- How to prepare for a compliance audit

- Conducting internal regulatory audits

- Audit advice for SMBs

- An easy-to-use compliance audit checklist

What is the purpose of a compliance audit?

A compliance audit evaluates how closely companies follow critical regulations. It delivers an outsider’s perspective on internal controls and systems. And it objectively assesses the quality of an organization’s compliance strategy.

Specific outcomes of a compliance audit include:

- A clear image of how organizations comply with regulations. Areas where action is required to meet regulatory requirements.

- Knowledge about how accurately the organization assesses risk. Compliance audits may identify areas of risk that internal assessors have not detected.

- Disciplinary action or training for employees who are found to breach regulations. Compliance audits may also detect criminal activity such as fraud.

- Action plans to add new security controls and update systems to reflect regulatory changes.

- Confidence in an organization’s internal processes. Managers have confidence that systems function properly and meet compliance goals.

- Improved ability to meet ethical goals and build trust in the organization’s core identity.

- Reduced exposure to regulatory penalties or legal prosecution. Compliance audits bring organizations in line with their regulatory obligations. This minimizes the scope for fines and other penalties.

Compliance auditing may also complement other types of audit. For example, an organization executes internal audits to prepare for regulatory audits. They may also schedule operational audits for processes or departments. These exercises check that components of the business are aligned.

What is the difference between a compliance audit and an internal audit?

The audit process above refers to internal compliance assessments. The process followed by external compliance auditors is similar. However, an internal audit is not the same as a compliance audit. Understanding the differences is important when organizing a compliance strategy.

The most critical difference is that external professionals execute compliance audits. Outsiders are involved because regulatory organizations do not automatically trust regulated entities to assess their compliance posture.

Compliance audits are carried out by independent assessors and generate unbiased results. Objectivity should result in better outcomes for regulated companies and the wider society.

There are exceptions to this situation. Depending on your PCI level and brand/acquirer compliance requirements, some organizations do not need to hire external auditors. Instead, they must complete self-assessment questionnaires and use external network scanning partners.

Internal audits also focus on the company itself. Assessors look at issues related to company structure and workflows. They may couple compliance auditing with efficiency assessments. And the audit may center around the company’s ethical mission instead of regulatory requirements.

Compliance audits focus on what regulators demand. They relate findings to regulatory goals. Auditors aim their reports at both clients and regulatory bodies.

Types of compliance audits

Compliance regulations and audits are critical for ensuring organizations meet legal, industry, and ethical standards. These frameworks help protect sensitive data, maintain financial integrity, and safeguard consumer rights. Here’s a brief overview of major regulations:

- GDPR (General Data Protection Regulation): The GDPR is a comprehensive data protection law that applies to organizations handling the personal data of EU residents. It emphasizes individual privacy rights and mandates strict data handling practices and breach notification procedures. Organizations must implement GDPR compliance services to meet these stringent compliance requirements.

- HIPAA (Health Insurance Portability and Accountability Act): HIPAA sets standards for protecting sensitive patient health information in the United States. It requires healthcare providers, insurers, and their business associates to implement safeguards for maintaining the confidentiality, integrity, and availability of protected health information (PHI). Organizations in the healthcare sector often seek HIPAA compliance solutions to meet these complex regulations.

- SOX (Sarbanes-Oxley Act): SOX is a U.S. federal law aimed at protecting investors by improving the accuracy and reliability of corporate financial disclosures. It mandates strict internal controls and financial reporting standards for public companies, holding executives personally accountable for the accuracy of financial statements.

- PCI DSS (Payment Card Industry Data Security Standard): PCI DSS is a set of security standards designed to ensure that companies accepting, processing, storing, or transmitting credit card information maintain a secure environment. Businesses handling payment card data must implement solutions to become PCI compliant to protect cardholder data and prevent fraud.

- SOC 2 (System and Organization Controls 2): Developed by the American Institute of Certified Public Accountants (AICPA), SOC 2 is an auditing procedure that assesses how a service organization manages customer data. The framework is based on five "Trust Services Criteria": security, availability, processing integrity, confidentiality, and privacy. It is especially critical for technology companies, cloud computing providers, and SaaS vendors.

- ISO/IEC 27001: This international standard provides a framework for establishing, implementing, maintaining, and continually improving an Information Security Management System (ISMS). Organizations can seek ISO 27001 compliance solutions to demonstrate a comprehensive commitment to information security management.

Preparing for a regulatory compliance audit

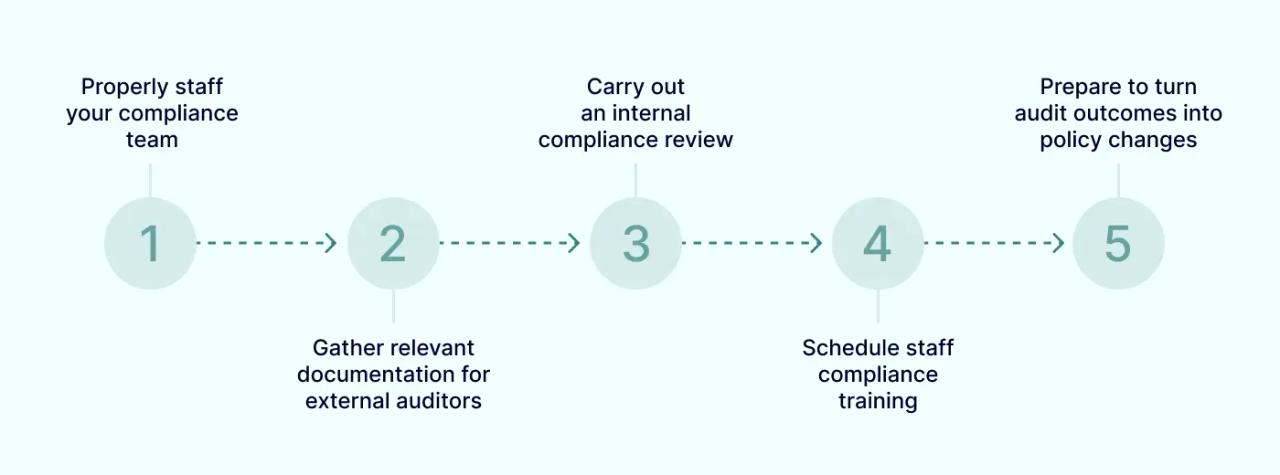

Organizations should carefully prepare for a compliance audit. Internal assessments correct compliance violations and verify that information is available to outside auditors. But auditors must diligently carry out this preparatory work. That way, organizations can extract maximum value from an external audit. The best way to achieve this is by following these simple steps:

1. Properly staff your compliance team

Companies should possess the expertise needed to create and manage compliance strategies. This team should identify relevant laws and regulations. And it should develop internal compliance policies and procedures to meet those regulations.

2. Gather relevant documentation for external auditors

A robust compliance strategy generates a clear and easily accessible compliance audit trail. This audit trail provides a historical record of access requests and user activity. Auditors will require information about physical access to data centers. They should also be able to call up access logs for cardholder data environments.

Compliance procedures should also include policy documents. Compliance policies detail measures used to meet regulations. For instance, companies can meet the regulatory goal of maintaining user privacy via encryption and online consent forms.

Make this documentation available for external auditors. And routinely assess the quality of compliance documents to ensure a high standard at all times.

3. Carry out an internal compliance review

It’s advisable to schedule an internal assessment shortly before external auditors arrive. This assessment resembles external compliance audits. It compares policy goals to actual processes and identifies any potential compliance violations. Document these violations alongside actions taken to mitigate them.

Internal assessments also help third-party auditors carry out high-quality evaluations. Auditors can quickly identify data processing infrastructure, access controls, and physical security measures.

4. Schedule staff compliance training

Before the compliance audit, make sure employees know and follow compliance policies. Training should be part of your regulatory strategy in any case. But it makes sense to schedule compliance training before carrying out annual audits.

5. Prepare to turn audit outcomes into policy changes

Compliance audits do not just show external regulators that organizations meet their obligations. They are also an opportunity to identify vulnerabilities and take remedial action.

Before the audit takes place, prepare your compliance team to act. Compliance officers should immediately use audit outcomes to reconfigure security controls, schedule training sessions, or rewrite policy documents.

How to conduct a compliance audit

Internal compliance audits require careful organization. The content of audit assessments varies from company to company. But a compliance audit tends to have the following format:

1. Appointing audit officers

The first step is deciding who will carry out the compliance audit. Within companies, this will usually be a senior compliance team member. Preferably, this officer will have experience in IT and cybersecurity.

2. Planning the compliance audit

Audit planning should consider the core aims of the exercise. The most important questions are about risk management.

Think about which risks the compliance audit will assess. Choose risks that are closely related to compliance goals. For example, PCI-DSS or SOC-2-compliant organizations should prioritize data breach risks.

If you have carried out compliance assessments in the past, use the outcome of these audits to inform the latest exercise. Use audit templates and risk management tools from previous audits. This generates a historical record and reduces the workload for assessors.

Comparing current compliance audit outcomes to previous findings provides evidence of change. Document any changes since the previous audit. New systems or processes will require additional assessment to ensure compliance.

3. Bringing in key stakeholders

Internal compliance auditing should have an enterprise-wide scope. Bring in stakeholders from all departments and C-suite management. Use meetings to establish the audit scope, timescales, and reporting arrangements.

4. Assessing internal controls and detecting compliance issues

Compliance auditors should assess:

- Internal controls to detect potential weaknesses. Examples could include encryption protocols and firewall configurations.

- Staff knowledge and behavior. Is training effective? Are employees putting data at risk?

- Whether compliance documentation accurately reflects the company’s internal systems.

- Access controls and privileges management systems. Is confidential data only available to relevant employees, or is it more widely exposed?

5. Risk assessment

After evaluating internal systems, the compliance auditor must determine the status of critical compliance risks. In some cases, this is a highly demanding part of the assessment.

For instance, financial institutions must consider many compliance regulation risks. Legislation like the Sarbanes-Oxley Act demands complex reporting. Banks must comply with data security regulations, anti-fraud laws, consumer protection regulations, and anti-money laundering legislation. That places a heavy burden on compliance officers.

Other companies have a higher risk appetite or fewer regulations to consider. In all cases, officers should evaluate whether existing controls mitigate core risks or whether there is an active risk to consider.

6. Reporting and verification

Compliance officers should compile internal audit results in a compliance audit report. Readers of the audit report should understand:

- How well the organization is managing regulatory risks.

- Any allowable risks, with an explanation for this status.

- Areas of improvement and information about mitigation actions.

Before presenting the audit report, compliance auditors should reach out to other stakeholders. They may request specialist feedback from IT teams or HR departments regarding security controls and training. This information may make it necessary to revise risk assessments.

Compliance audit for SMBs

SMBs must comply with regulatory auditing requirements just like global giants. And this is usually a good thing. Benefits like improved data security flow from a robust compliance strategy.

However, smaller companies are not as well-resourced as multinational corporations. They can’t always maintain compliance departments or even assign a specialist compliance officer. So what is the best auditing approach for a small business?

SMBs should simplify the compliance audit process with templates and checklists like the one below. In most cases, enlisting external expertise will help ensure compliance.

This does not mean hiring a full-scale auditing team. External professionals can advise about relevant regulations, critical risks, and appropriate control. They clarify the compliance task, saving time and money for SMBs.

SMBs can also leverage compliance software to reduce their regulatory burden. Automation tools establish a compliance schedule and ensure that companies meet regulatory milestones. Suppliers build compliance tools around regulations such as the Health Insurance Portability and Accountability Act (HIPAA) or PCI-DSS. And they significantly reduce the risk of missing deadlines or neglecting compliance tasks.

Compliance audit checklist

Compliance audits are crucial exercises with a significant impact on business success. They can be complex at first glance. But if you follow this checklist, you can make the auditing task simpler and cover every relevant area.

1. Regulatory context

Companies must know what regulations apply to their operations. Carry out a full assessment of relevant regulations. Set out which areas of these regulations apply to your business and include separate sections in your audit documentation for each regulatory framework.

For example, a company that develops and sells health monitoring apps will probably have to be PCI-DSS compliant (if it stores, processes, or transmits cardholder data). However, organizations that store patient data must also comply with the Health Insurance Portability and Accountability Act. If the developer sells its app in the EU, the company must comply with GDPR regulatory guidelines.

2. Policies and procedures

Review your internal compliance policies. Make sure to include every regulatory risk. And verify that employees are following procedures correctly. Check whether compliance policies are available to all employees and that policy documents form the basis for employee training.

3. Risk management

Create a database of critical regulatory risks. Each risk corresponds to a possible regulatory violation. For example, the risk of malware infection relates to PCI-DSS rules on network security.

Classify each risk as low, medium, or high priority. High-priority risks are likely to occur and significantly impact business operations. Focus on these risks first when carrying out the compliance audit.

4. Data and network security

Work with your IT team to audit the integrity of cybersecurity and information security policies. List data security controls that operate on your systems. Evaluate whether these controls are functional and provide enough protection for confidential data.

Assess network security as well. Check firewall configurations. Verify that devices are receiving timely updates. And double-check that network and penetration scans meet regulatory requirements.

5. Privacy and access control

Check that data storage and processing systems are compliant with privacy rules. For example, websites must request consent to store and share customer data under CCPA and GDPR. HIPAA also enforces strict privacy rules on patient data.

Check access controls and authentication systems. Ensure that only authorized users can access private data. Minimize the number of administrative accounts. Check that employee accounts are being deleted as their owners leave the organization.

6. Employee behavior

Regulated entities must generally meet employee training standards. Check that new hires are receiving relevant training. Verify that all employees follow security policies and that policy breaches are penalized. Make training recommendations to improve compliance where necessary.

7. Logging and assessment

Auditors should have access to clear audit trails. Check the audit logs of critical assets. Verify that logging systems deliver information about access requests, user activity, and security alerts. Check that information is up to date and retained for the required amount of time.

Compliance may require regular security audits. Are security teams executing audits as required? Check that security officers are documenting audits and scans. And verify that scans lead to actions when issues are detected.

8. Finance

If applicable, check financial systems for compliance violations. Companies must meet reporting requirements for financial records, and organizations regulated by the Sarbanes-Oxley Act must follow detailed transparency rules. Financial institutions may have additional compliance duties relating to asset reserves, money laundering, and fraud protection.

9. Third-party compliance

Regulations may require information about vendor or supplier relationships. For example, third parties may qualify as “business associates” under the HIPAA Omnibus Rule. Companies may need to audit partners to verify their security controls. Auditors should check that partners meet recognized security standards such as SOC 2.

Businesses reliant on cloud computing may also depend on third-party service providers. Compliance audits should show that service providers can protect customer data in the cloud. Or the audit should explain how this qualifies as an allowable risk.

10. Incident responses

Compliance auditors should investigate any security alerts over the reporting period. Has the company informed customers as required by regulatory guidelines? Did the alert trigger the company’s incident response plan as described in policy documents?

This section should document any mitigation actions taken in response to incidents.

11. Compliance reporting

The compliance audit report should evaluate whether the organization has met regulatory reporting requirements. This includes the self-assessment documents, attestations of compliance, and other relevant submissions.

Conclusion: use compliance audits to meet regulatory requirements

A compliance audit is an external or internal audit of a company's systems and processes that evaluates whether the company meets regulatory standards. Internal audit exercises supplement but do not replace external audits. Compliance audits are usually independent and unbiased. Certification/attestation audits are performed by independent third parties; internal compliance audits aim for objectivity but are conducted within the organization’s governance structure.

Compliance audits cover regulations as diverse as Sarbanes-Oxley, HIPAA, and SOC-2. The outcome is a clear picture of how well the audited organization manages compliance. This enables companies to detect weaknesses and achieve certification for the most important regulations.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. The laws, regulations, and penalties discussed are subject to change and may have been updated since the time of publication. We recommend consulting with a qualified legal professional for guidance on your specific compliance needs.