Healthcare companies face a complex regulatory challenge. But compliance failures can lead to fines, cyberattacks, and reputational damage. This article explains what healthcare compliance is. Readers will learn about the most important healthcare regulations. And we will explore ways to create effective healthcare compliance programs.

Key takeaways

- Healthcare compliance involves following legal, ethical, or technical rules in the healthcare industry.

- The most important federal regulation is the Health Insurance Portability and Accountability Act (HIPAA), but many other rules and regulations affect healthcare operations. Companies should be familiar with all relevant regulations.

- Compliance avoids penalties, builds patient trust, and creates a company culture dedicated to security, privacy, and patient needs.

- Compliance strategies in healthcare should focus on protecting Private Healthcare Information and ensuring patient privacy.

- The best route to healthcare compliance is by creating a comprehensive compliance program. Compliance programs create policies, assess risks, train employees, and report potential violations.

What is healthcare compliance?

Healthcare compliance involves meeting regulatory requirements in the healthcare industry. To be compliant, healthcare companies must adhere to a range of laws, ethical frameworks, and technical standards.

Healthcare compliance is based on risk management. Organizations must assess which regulations apply to their operations. They must identify critical risks associated with those regulations. And they should implement measures to minimize those risks.

Risks in the healthcare sector could include the exposure of confidential patient data or direct risks to human safety during patient care. Health companies are subject to financial regulations relating to customer relations and reporting. So, there are many risks and laws to consider.

Why is compliance in the healthcare industry important?

Healthcare compliance matters because patient care and confidentiality are extremely important. Regulations protect patients from avoidable harm. They also protect patient privacy against data thieves or other malicious actors.

Robust compliance has other benefits. Compliant companies tend to build trust with patients and customers. Trust is all-important in healthcare settings or when selling insurance policies. Companies that protect data and avoid regulatory penalties will benefit by retaining customers and generating revenue.

Who regulates healthcare compliance?

The Office of Inspector General (OIG) within the Department of Health and Human Services (HHS) is responsible for tracking fraud and abuse in Federal programs like Medicare and Medicaid. If Health and Human Services suspect non-compliance with laws like HIPAA, the OIG can launch investigations and prosecutions.

Medicaid and Medicare also fall under the authority of the Centers for Medicare and Medicaid Services (CMS). CMS approves and audits all providers of these Federal programs. It investigates non-compliant providers and defines general guidelines for program participants.

The Office for Civil Rights (OCR) handles HIPAA privacy regulations. OCR is a subsidiary of HHS and regulates providers, insurance companies, and clearinghouses. If the agency detects privacy violations or data security breaches, it has the power to launch prosecutions and levy HIPAA fines.

At the state level, local health departments license practitioners and patient care facilities. States can also implement healthcare policies in areas not covered by Federal legislation. For example, states might have different infection control regulations or thresholds for reporting adverse events.

Compliance professionals handle regulatory tasks within healthcare companies. Healthcare compliance officers typically carry out risk assessments based on relevant regulations. They recommend privacy and security controls, develop policies, and execute compliance audits. This role is central to maintaining healthcare compliance across the organization and preventing costly violations.

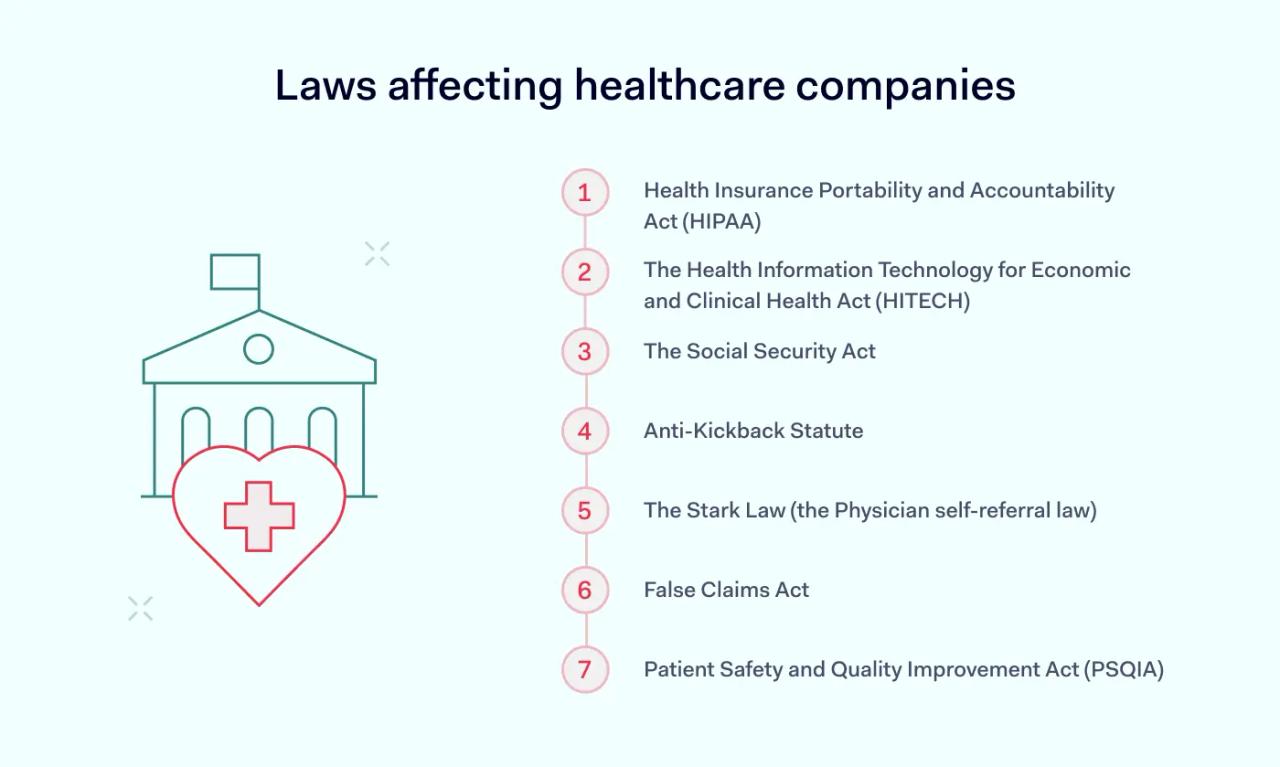

What laws affect healthcare compliance?

Most healthcare regulations are federal laws. Knowing the most significant laws is critically important when creating healthcare compliance strategies. Laws to consider include:

Health Insurance Portability and Accountability Act (HIPAA)

First passed in 1996, HIPAA protects patient privacy and ensures the portability of health insurance policies. Since its enactment, the scope of the Act has steadily expanded to become the most wide-ranging set of healthcare compliance regulations.

Title II provisions enacted in 1999 regulate the storage and transfer of electronic health records. The Privacy Rule was passed in 2000. It requires providers to make private information available to patients and mandates strict data protection policies.

The Security Rule defines minimum data security standards for companies processing protected health information (PHI). In addition, 2013’s Omnibus Rule updated every aspect of HIPAA, including new rules on breach notification.

In its most recent form, HIPAA requires healthcare organizations to:

- Maintain policies to protect PHI and allow patients access to their data

- Put in place security controls to encrypt data and prevent unauthorized access

- Apply minimum disclosure rules to limit the use of PHI

- Report data breaches to regulators and patients

- Sign and audit Business Associate Agreements with third parties

Violations of HIPAA carry significant financial penalties. Penalties are assessed in four Tiers. In the worst cases, fines can total $50,000 per violation and up to $1.9 million per year.

The Health Information Technology for Economic and Clinical Health Act (HITECH)

Congress passed HITECH in 2009 as a complement to HIPAA. The HITECH Act aims to promote the adoption of modern IT in healthcare systems, including secure data handling technology.

HITECH strengthens existing privacy provisions and breach notification guidelines. It also requires organizations to demonstrate “meaningful use” of certified electronic health record (EHR) technology.

EHR technology aims to standardize the storage of healthcare information. And it also includes robust data protection standards to secure data passing through the healthcare system.

The Social Security Act

The Social Security Act regulates healthcare companies that work with Federal government programs like Medicaid or Medicare. These regulatory standards assess providers to prevent fraud and abuse within the social security system.

Company policies must prevent fraud and billing violations. Organizations must make health services available to all beneficiaries of Federal programs. Regular audits should detect and remedy discrimination.

The Children's Health Insurance Program (CHIP) presents additional regulatory challenges. This federal government program subsidizes healthcare for young children. Companies must monitor eligibility requirements and meet patient care thresholds. Because minors are involved, data privacy is doubly significant for CHIP providers.

Anti-Kickback Statute

The AKS prohibits financial incentives for healthcare professionals to make prescriptions or referrals.

Under the AKS, healthcare professionals cannot accept financial or non-cash incentives for third-party services. AKS makes it vital to keep clear records of promotional offers or transactions between commercial partners.

The Stark Law (the Physician self-referral law)

Under the Stark Law, physicians and other healthcare professionals cannot refer patients to family members or entities with which the referrer has a financial connection.

Regulated bodies must keep records of referrals and provide evidence that they have policies to prevent conflicts of interest.

False Claims Act

The False Claims Act makes it illegal for a healthcare organization to make false claims for remuneration from Federal bodies. This regulation requires accurate documentation of billing and coding policies. And healthcare compliance violations can lead to damages equivalent to three times the initial fraud amount.

Patient Safety and Quality Improvement Act (PSQIA)

In force since 2005, PSQIA seeks to improve the quality of patient care. Clinical providers are encouraged to work with Patient Safety Organizations (PSOs) to improve and document care. The Act advises providers to report Patient Safety Events (PSEs) voluntarily.

Top healthcare compliance challenges

The high number of regulations makes formulating a healthcare compliance plan complex. Compliance teams and executives must handle many issues and take a careful approach. Common challenges include:

Securing PHI: Meeting HIPAA privacy and security requirements demands strict data protection, patient consent protocols, and constant vigilance against breaches.

Keeping up with regulations: The legal landscape evolves quickly. Staying updated on new rules and planning proactively is essential to avoid compliance gaps.

Data sharing & standardization: Ensuring interoperability and consistent data storage across systems is especially challenging for smaller providers.

Managing third-party risks: Partnerships with external vendors require formal Business Associate Agreements and regular audits to secure data flows.

Maintaining documentation: Compliance involves tracking billing, data incidents, and vendor activity—often overwhelming without proper systems.

Balancing limited resources: Healthcare providers must juggle patient care with compliance duties, often under tight budgets and staffing constraints.

What happens when you're non-compliant

Regulatory penalties are particularly severe in healthcare, where patient safety and privacy are a priority.

Breach penalties vary. HIPAA violations can lead to fines of almost $2 million per year. If more than one violation is involved, fines can become ruinous. For instance, insurer Anthem had to pay $16 million for data security breaches in 2018.

Other regulations operate in the same way. The maximum penalty for breaching the False Claims Act is $27,018 per violation. But prosecutors can investigate multiple violations, resulting in penalties as high as $25 million.

The consequences of non-compliance extend beyond financial penalties. For example, PHI disclosure or repeated failures to rectify compliance violations can lead to criminal prosecution under HIPAA.

Healthcare companies with poor compliance records also expose themselves to cyberattacks and data breaches. Weak firewall or access management systems can lead to ransomware attacks and network failure.

Companies suffering breaches lose more than data. They lose the trust of existing and potential customers. Trust is critical in healthcare, where customers provide companies with the most confidential information.

How can healthcare organizations ensure compliance?

Non-compliance can have serious consequences for healthcare companies. But there are ways to mitigate compliance risks. And the price of ensuring healthcare compliance always outweighs the cost of violations.

A robust compliance plan begins with company culture. Every employee should know their regulatory duties. Compliance teams should explain employee duties in clear policy documents. Staff should learn about compliant conduct via engaging, comprehensive training.

Compliant healthcare providers are also vigilant. They know that violations can occur at any stage. Responsible companies put in place monitoring systems to assess privacy and security controls. They operate a compliance plan to track regulatory developments. And they take proactive steps to meet their obligations. And they audit their compliance strategies with the goal of continual improvement.

Successful healthcare organizations allocate resources to compliance departments. And they empower their compliance officer to create effective compliance programs. Executive support backs up compliance teams, giving them the confidence to tackle urgent challenges.

Components of a healthcare compliance program

Compliance programs systematically classify, control, and audit regulatory risks. A well-designed program includes all healthcare compliance requirements under a single plan. Data security, privacy, fraud prevention, incident reporting, auditing, and managing business associates are all part of the same program.

While company strategies vary, the steps involved in a compliance program generally follow the same pattern.

1. Appoint a Chief Compliance Officer

The first stage is creating compliance structures. Designate a CCO or advertise for an external compliance expert. This individual manages the compliance program and should have extensive knowledge of relevant regulations.

The CCO should have sufficient resources to assess risks and put in place controls. And they should report directly to the company board. Direct reporting provides the authority needed to force through complex changes.

2. Create and distribute compliance policies

Compliance officers must create policies that describe processes and controls within the organization. In the healthcare context, policy themes include:

- Avoiding conflicts of interest

- Coding insurance claims

- Ensuring patient privacy

- Secure data access and data handling rules

Every employee and associate should receive digital copies of compliance policies. Use digital signatures to verify that recipients have opened the documents as requested.

3. Train employees in compliance best practices

Policies mean little without effective training. Create training materials that explain policies and expected behavior. These materials should relate to everyday concerns and teach employees what compliance means on a practical level.

Group meetings and role plays can reinforce employee knowledge. And companies should regularly refresh and update compliance training as new regulations emerge.

4. Put in place internal reporting systems

Healthcare regulations require that companies empower healthcare workers to report potential violations. Every effective compliance program should protect whistle-blowers and provide confidential encrypted communication channels to receive their reports.

5. Schedule regular compliance audits

Audits prove that organizations have achieved compliance or identify areas where compliance is weak. Healthcare companies should schedule annual audits as part of their compliance plan. These audits should assess privacy and security vulnerabilities. And the outcomes should feed into risk mitigation strategies.

6. Implement penalties for policy violations

Policies should document internal penalties for compliance breaches. Compliance officers should require sign-off from employees to confirm that they understand these penalties.

Compliance teams should proactively respond to possible violations. Officers should transparently apply penalties. And they should use violations as an opportunity to reassess compliance policies.

Healthcare compliance checklist

Healthcare compliance is a complex challenge for insurers, clinical providers, clearinghouses, and even health app developers. But the challenge is not unmanageable. Following this quick checklist will help organizations create an effective healthcare compliance program:

- Ensure your compliance team is skilled and correctly staffed

- Understand which regulations affect your healthcare organization

- Assess regulatory risks and determine priority tasks

- Put in place data security and privacy controls

- Ensure staff can report violations

- Audit compliance strategies and make any necessary improvements

- Meet reporting requirements as regulations demand

Disclaimer: This article is for informational purposes only and not legal advice. Use it at your own risk and consider consulting a licensed professional for legal matters. Content may not be up-to-date or applicable to your jurisdiction and is subject to change without notice.