The Sarbanes Oxley Act is the primary regulatory framework for publicly traded companies in the United States. Passed in 2002, the Sarbanes Oxley Act regulates domestic companies and US-based subsidiaries of foreign companies. Non-compliance often leads to significant fines and may incur criminal penalties. Companies need a rock-solid SOX compliance strategy to avoid those outcomes.

SOX violation definition

A SOX violation occurs when a company breaches the clauses of the Sarbanes Oxley Act of 2002. Violations range from high-profile frauds to individual balance sheet errors by low-level employees. In all cases, robust SOX compliance measures cut the risk of violations and limit exposure to regulatory action.

The difference between intentional and unintentional violations

The Sarbanes Oxley Act draws a distinction between intentional and unintentional violations.

To be clear, all violations of SOX incur penalties, whether they are intentional or not. However, penalties vary depending on whether regulated entities knew about violations and had the opportunity to rectify problems.

Intentional violations include deliberate misconduct. Violations could include bypassing internal controls to change financial statements. Examples also include insider trading or changing financial data to mislead investors.

Wilfully failing to adapt data security and financial reporting systems to meet SOX standards is also an intentional violation. For example, publicly traded companies may deliberately decide not to improve their systems as a cost-saving measure.

Intentional violations are viewed more seriously by regulators and customers. They often lead to criminal or civil prosecution and will likely incur significant financial penalties.

Unintentional violations include most errors or oversights. For example, employees may enter financial data incorrectly or leave data exposed by improperly applying controls. Companies may also inadvertently fail to meet SOX compliance standards.

Unintentional violations generally do not represent criminal offenses. The SEC may not issue fines, preferring to require remedial action. However, even unintentional offenses lead to significant penalties if the consequences are severe.

Key takeaways

- SOX 2 is the main regulatory framework for publicly traded companies in the USA. Robust SOX compliance strategies avoid penalties and prosecutions. Under SOX, violators can receive prison terms of 20 years. The Securities and Exchange Commission can fine individuals up to $5 million. Company fines can reach $25 million.

- Common SOX violations involve executive certification (Section 906) or criminally altering documents (Section 802). Executives are responsible for financial reporting and data security. Internal and external audits reduce the risk of SOX penalties. Companies must implement controls to limit access. Training programs foster a culture of compliance. Cross-departmental collaboration connects SOX stakeholders to handle compliance challenges.

- Cases like ArthroCare, QSGI Inc., and Monsanto show how easy it is to violate the Sarbanes Oxley Act. Ensure compliance by creating an ethical culture, implementing controls, and making SOX compliance a central component of business operations.

Penalties for SOX violations

SOX requires an organization's Chief Executive Officer (CEO) and Chief Financial Officer (CFO) to provide a written attestation of compliance. This attestation is part of all financial statements filed by the company. It states that the report accurately represents the organization's financial condition.

Many violations relate to this written statement, which legally confirms a company meets SOX key provisions to an "adequate" level. When regulators discover violations, the executives who signed a false attestation are legally responsible.

Section 906: Corporate responsibility for financial reports

SOX Section 906 legally explains attestation requirements. This part of SOX legislation seeks to improve transparency, enforce accurate reporting, and promote investor confidence. It places many critical burdens on the shoulders of corporate leaders. CEOs and CFOs must ensure:

- Annual and quarterly financial statements accurately portray the company's financial health.

- External audits have confirmed the effectiveness of the company's internal controls. Internal controls safeguard financial data and protect sensitive information against unauthorized tampering.

- Executives confirm that auditors receive reports about weaknesses in internal controls and that the organization has taken remedial action.

Corporate executives are personally responsible for certifying all financial statements. They are responsible for internal misconduct and instances of corporate fraud, along with any cases of misleading financial statements.

Violations of Section 906 are severe. Executives face maximum prison sentences of 20 years and/or fines of up to $5 million.

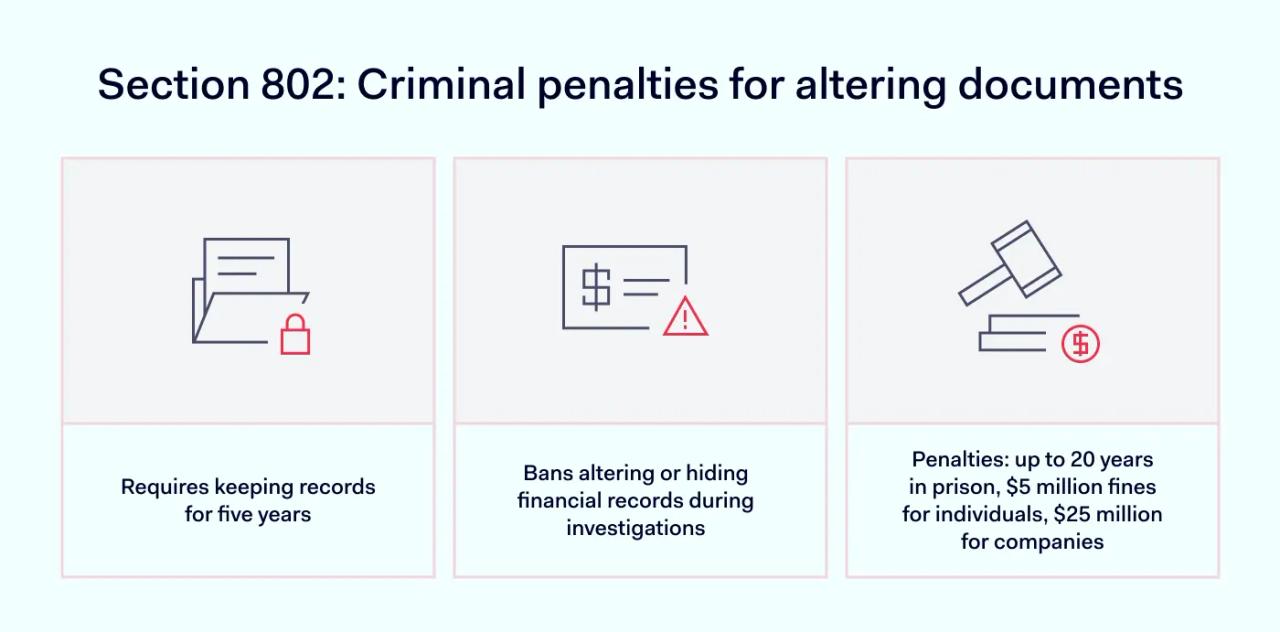

Section 802: Criminal penalties for altering documents

Section 802 is another foundational component of the SOX regulations. This section of the legislation seeks to prevent criminal offenses relating to changing financial documents. Investigators and investors must have access to accurate documents that are not vulnerable to alteration.

Documents covered by this clause include financial statements. However, the scope of Section 802 also includes emails, reports, or data used in preparing statements. Requirements under Section 802 include:

- Controls on the alteration, removal, deletion, or concealment of financial documents to obstruct a legal investigation.

- Accurate data retention and activity logging. Companies must retain all documents relating to the preparation of financial statements and transactions. SOX sets out a retention period of 5 years for all in-scope documentation.

Penalties under Section 802 are similar to Section 906. Individuals found guilty of illegally tampering with financial documents face up to 20 years in prison. Courts can fine individuals up to $5 million, while companies face fines of up to $25 million per offense.

Not all data alteration or deletion counts as a Section 802 violation. SOX includes an intent requirement to prevent unfair prosecutions for minor or accidental errors.

Serious violations occur if an individual acts deliberately to obstruct investigators. This action could occur during investigations, but hiding financial irregularities also counts as a SOX 802 violation. Penalties under the Sarbanes Oxley Act of 2002 also vary according to severity and levels of obstruction.

How can audits prevent violations and ensure compliance?

Internal and external audits ensure compliance by mitigating potential violations under Sections 802 and 906. Auditors assess internal controls and recommend improvements to meet SOX compliance standards.

For example, external auditors assessing Section 802 compliance verify access management and data protection controls. They test systems to identify any possible way to make misleading financial statements.

Auditors check data retention policies and backups to ensure compliance. They also check governance issues such as segregation of duties. This part of the audit ensures every financial process is subject to checks and balances.

When assessing Section 906 compliance, auditors focus on the certification process. They check internal assessment procedures, gathering evidence that the Chief Executive Officer understands SOX compliance systems.

Auditors verify documentation, ensuring executives have an adequate evidence base to certify compliance. They may also simulate the certification process, double-checking its integrity and accuracy.

On a general level, auditors report potential compliance violations to stakeholders. They recommend remedial actions and provide an opportunity to align internal controls with SOX requirements.

How organizations can avoid SOX violations

A robust compliance strategy prevents violations and avoids financial or criminal penalties. Effective SOX compliance strategies have many components, with strands for each regulatory clause. The SOX best practices listed below simplify the challenge and provide a solid foundation for avoiding violations.

Importance of internal controls and reporting methods

Internal controls play three critical roles in preventing Sarbanes Oxley Act violations.

Firstly, controls ensure transparency. The control environment logs activity related to financial data and establishes communication lines with auditors. Controls protect whistleblowers and enforce systematic reporting to key stakeholders. They also manage access to financial data, ensuring only authorized individuals can amend or delete records.

Controls also promote accurate recording and reporting of financial information. Effective controls ensure transactions appear on financial statements without amendments or omissions.

Standardized recording processes cover every employee and corporate asset. Automated controls also make filing financial statements easier. This cuts the risk of missed deadlines and enforcement penalties. Moreover, controls detect instances of fraud and secure assets against external threats.

Thirdly, controls promote accountability. Controls include oversight of those handling financial data, alongside certification requirements for executives. Policy controls define and enforce ethical behavior and provide a baseline to ensure employees remain SOX compliant.

The type of controls employed varies between companies. However, routinely-used SOX internal controls include:

- Segregation of duties. Restricting the ability of individuals to manipulate financial data

- Access controls. Blocking access to critical data unless users have a legitimate business justification. Access management includes digital measures and physical access controls.

- User monitoring. Tracking user activity, including access to data. Recording changes made to financial statements and the time of user actions.

- Risk assessment. Determining compliance risks relating to financial data. Assessing the severity of compliance risks and tabling mitigation actions in response.

- Control environment. Creating a compliant governance structure with defined responsibilities and reporting processes. Adopting leadership practices that encourage ethical and compliant behavior.

- Internal audits. Processes to monitor Sarbanes Oxley Act compliance and identify violations. Regular internal reports documenting security alerts and control performance.

- Documentation. Keeping records relating to financial reporting and operational controls. Ensuring access for external auditors so they can certify the company is SOX compliant.

The role of ongoing training and awareness programs

Preventing violations of the Sarbanes Oxley Act requires a culture of compliance. Training and awareness programs explain the compliance obligations of employees. They encourage stakeholders to handle financial data responsibly in line with Sarbanes Oxley requirements.

On a basic level, training programs should spell out SOX requirements. Employees must know what constitutes a reporting violation and the implications at an enterprise level. Corporate roles should have clear SOX responsibilities. Everyone should know how their actions relate to corporate compliance.

It is also strategically advisable to link SOX training with ethical commitments. Create an ethics policy that foregrounds transparency, accountability, and accuracy. Stress that SOX compliance stretches from entry-level employees to the Chief Executive Officer.

Every staff member must follow the company's ethical principles—especially when handling financial data. For instance, staff should understand SOX rules about accounting firms. Staff should know what constitutes improper incentives or bribery.

Beyond ethics, training should encourage employees to be vigilant and identify potential violations. Create graphics or posters highlighting warning signs. Create a confidential communication channel to raise concerns. Ensure everyone knows that whistleblowers will enjoy complete protection.

Collaborative efforts between financial, IT, and audit teams

SOX compliance is a team effort. Cooperation between IT staff, financial officers, and auditors is critical. Collaboration matters because compliance involves cross-dependencies between these three core departments.

IT teams manage technical controls and create secure storage systems for financial information. Finance teams record, process, and report financial data. Auditors assess reporting processes and internal controls to ensure compliance with the Sarbanes Oxley Act.

These tasks must align with each other and SOX compliance goals. For example, financial recording systems should meet the operational needs of finance teams and integrate compliant controls recommended by IT specialists. IT teams can identify insecure data handling practices and mitigate data breach risks.

Critical teams cannot operate in silos. Companies need collaboration systems that bring together departmental stakeholders. Each department should contribute its expertise and perspective to compliance strategies and risk assessment exercises.

Sharing knowledge raises general compliance awareness and cuts the risk of unintentional violations. Collaboration also makes it easier to implement continuous compliance. Teams collaborate to identify weaknesses and adapt finance systems to the changing business environment.

Real-life cases of SOX violations and lessons learned

Sarbanes Oxley Act violations are not rare. For instance, in 2022, the Securities and Exchange Commission reported 760 enforcement actions and levied penalties of $6.4 billion. Cases related to diverse violations, from filing delays to barring officers due to criminal convictions.

Every one of these enforcement actions was avoidable. Companies should learn from the mistakes made by others and ensure they do not appear on next year's SEC enforcement report. Let's consider a few case studies to explore where compliance teams went wrong.

QSGI Inc: Certification failures at the executive level

In 2014, the SEC charged executives at IT equipment manufacturer QSGI with "misrepresenting the state of its internal controls."

Executives at the company filed a report in 2008, attesting they had certified internal controls and made transparent disclosures to their external auditor. None of that was true. One executive had been doctoring the accounts, artificially improving QSGI's financial position. These actions made it easier to borrow money but invalidated financial statements filed by the company.

Following the identification of the violations, QSGI failed to improve its internal controls relating to product inventories and transaction records. The SEC found that this was due to inadequate staff training and flawed recording systems.

Lessons learned: QSGI shows that companies need robust internal controls to document transactions. But they also need to ensure employees have the skills to operate recording systems properly. Executives should thoroughly certify controls, and red flags should lead to immediate remedial action.

Monsanto: Smart marketing but negligent SOX compliance

In 2016, the SEC fined pharmaceutical giant Monsanto $80 million under the Sarbanes Oxley Act of 2002 for accounting irregularities. Monsanto was penalized for not recording state-funded rebates when selling its Roundup pesticide to American clients. According to the SEC, not recording rebates inflated Monsanto's paper earnings over three years.

This strategy made sense from a marketing perspective. Monsanto needed to compete with cheaper alternatives. However, the company misled investors, leading to a massive SOX enforcement action.

Lessons learned: The Monsanto case shows the need to determine which revenue streams are in scope for SOX compliance. Internal controls must ensure all transactions are recorded accurately and appear on financial statements. The case also illustrates the risk of chasing short-term revenues at the expense of SOX compliance.

ArthroCare: How violating SOX can lead to prison time

In 2018, the ex-Chief Financial Officer of medical devices company ArthroCare started a 50-month prison sentence for carrying out a $750 million fraud. In the 2000s, Gluk and colleagues routinely misstated ArthroCare's end-of-quarter revenues by offering fake incentives to distributors in exchange for product shipments.

These misstatements inflated the company's paper sales, making it look like ArthroCare was beating Wall Street forecasts. In reality, the business was far less healthy—eventually costing investors millions.

Lessons learned: ArthroCare is a classic example of the need for ethical leadership. As Chief Financial Officer, Gluk operated a team of executives and account managers who dealt with distributors. Poor leadership corrupted the entire company to meet sales targets. Lax business ethics led to a casual attitude towards internal controls, which could not stop or detect fraudulent actions.

Conclusion: The lasting impact of the Sarbanes-Oxley Act

SOX compliance is vital for companies that sell securities in the United States. Since Congress passed the Sarbanes-Oxley Act act in 2002, Sarbanes-Oxley has dominated corporate compliance, creating a complex ecosystem of auditors, technical solutions, and regulatory activity.

Most commentators agree that SOX has made perpetrating corporate fraud harder and promotes a more transparent business culture. For example, Sections 302 and 906 have changed the roles of CFA and CEO. Executives now face strict penalties and must take responsibility for ethics throughout their organizations.

Accounting firms have also changed their operating style. Accounting firms must now create clear dividing lines with clients and avoid conflicts of interest. The porous boundaries between auditors and clients that contributed to Enron's downfall no longer exist.

Subsequently, cases like Enron and WorldCom have not returned—at least not in the United States. There have been similar scandals in Europe and the UK. In response, countries are now adopting SOX-style legislation to emulate America's example.

That success is no reason for complacency. Companies must be vigilant and proactive when meeting SOX compliance goals.

One of the core takeaways from SOX is that all organizations are vulnerable to malpractice, criminality, and errors. Companies need controls and policies that mitigate those vulnerabilities. Complying with SOX is the best way to achieve this.

Disclaimer: This article is for informational purposes only and not legal advice. Use it at your own risk and consider consulting a licensed professional for legal matters. Content may not be up-to-date or applicable to your jurisdiction and is subject to change without notice.