What is a third-party risk assessment?

A third-party risk assessment considers vendor risk assessments and supply chain risks associated with third parties. It cuts external threats while onboarding third-party vendors to support business processes.

Any third party can introduce compliance risks or cyber threats. This makes company assets and systems more vulnerable. Integrating third-party risk assessments into your risk management strategy is essential.

This article will explain why third-party risk assessments matter. And we will provide a simple, practical guide to assessing suppliers—including how tools like an enterprise browser can support secure access.

Key takeaways

Third-party risk assessment is a critical part of general risk management. Companies should carry out vendor risk assessments for all external partners. Risk assessments

protect sensitive data. They cut operational disruption. And they ensure that third-party relationships are compliant.

Due diligence is essential when assessing third-party risks. Risk assessments should include comprehensive evaluations of external suppliers. Critical areas include data security, geographical location, compliance risks, and incident recovery processes.

Assessors should grade third-party vendors. Assessments should focus on operational importance and the ability to access sensitive data. Concentrate on partners with the capacity to compromise security or damage internal systems.

Third-party risk management is a continuous process. Companies should update risk assessments and check that they cover relevant third-party risks.

What is a third party?

A third party is an external agent that contracts with another company to supply goods or services. Many companies rely on third parties. External partners support their work and make operational savings. Sometimes, companies rely on thousands of external partners.

Examples of third parties

Common examples include:

Professional office services.

Marketing partners.

Call centers and customer support services.

Freelancers like coders, secretarial support staff, technicians, writers, videographers, and corporate trainers.

Financial support. Includes accountants and partners for storing financial and customer data.

Cloud service providers.

Security vendors.

Travel and employee services.

ISPs.

Importance of third-party risk assessment

Companies should never cut corners when assessing external partners. There are many reasons to implement a comprehensive third-party risk management strategy.

Meeting regulatory requirements

Many data security regulations demand third-party risk assessments. Regulations with third-party requirements include:

Companies that assess third parties will strengthen compliance. And they will reduce their exposure to regulatory risks.

Certainty about cybersecurity risks

Most third-party vendors introduce cybersecurity risks. Comprehensive vendor risk assessments provide information about the cybersecurity practices of external partners. They allow companies to choose secure partners. Enterprise browsers can be an extra line of defense, ensuring vendors operate in a secure, monitored space.

Avoiding reputational damage

Customers trust companies with a commitment to security and transparency. Organizations that lose data or suffer regular downtime due to poor security struggle. A third-party risk assessment filters out partners with poor operational or security records. Screening partners improves the customer experience. It guards against attacks that ruin corporate reputations.

Financial protection

Supply chain attacks are a common source of data breaches and malware infections. And cyber-attacks can have a devastating impact on your corporate bottom line. Data breaches cost money to compensate customers. Companies must pay regulatory fines, and invest in updated security technology. And you can prevent these costs by risk-assessing every third-party relationship.

Strategic efficiency

Robust vendor management allows companies to move forward. With dependable long-term partners in place, organizations can plan their mid-range goals. There should be no need to swap partners every six months.

Solid risk assessment processes lead to long-term relationships. And these relationships are the basis for an effective corporate strategy.

Third-party risk types

Dividing risk allows assessors to generate more precise outcomes. It also gives managers a fuller picture of risks that each third party poses. Critical types of third-party risk include:

Cybersecurity risks

Third-party vendors often have access to internal networks and customer data. Partners with network access could expose your company to cybersecurity risks. A supplier risk assessment must establish which cybersecurity risks apply. It must also suggest appropriate action.

For example, you might use a third-party Customer Relationship Management (CRM) system. This supplier could pose an information security risk. The third party could expose customer data through poor cybersecurity controls.

Operational risks

Operational risks threaten everyday company operations. This category includes business continuity threats to network infrastructure and applications. But operational risks also cover the physical integrity of office spaces. And they include the ability of remote workers to connect. Third parties can also pose operational risks when their systems or products fail.

Compliance risks

Third parties pose a compliance or regulatory risk. This happens when their products or services breach regulatory rules. For example, HIPAA demands tight information security and privacy for patient records. But an email filtering service with poor security controls could put this data at risk. Risk assessors should consider every relevant regulation when analyzing potential suppliers.

Financial risks

Financial risk or organizational risk affects revenues and profits. Third-party relationships often help companies become more efficient. But the failure of vendor-supplied solutions can harm your finances. Vendor failure may immobilize payment portals. Or it could leave employees without access to critical resources. Vendors can also go out of business, leaving partners in limbo.

Strategic risks

Strategic risks refer to long-term effects on how a company operates. Third-party relationships should be durable. But supplier quality can decrease. Security practices can lapse, or partners may stop operations. Companies must consider business strategy 2 or 3 years into the future. Will third parties still be reliable partners?

Consequences of neglecting third-party risk assessment

What happens if you fail to assess third-party risks properly? In reality, the consequences can be damaging. Common results include:

Regulatory breaches and penalties

Lost customer trust and market share

Increased downtime and network integrity

Escalating cyber-attacks and security costs

Loss of strategic control with constant changes in supplier arrangements

Poor relationships with third parties as disagreements mount

Inflexible supplier management if risk assessments are not updated

Related Articles

Anastasiya NovikavaAug 30, 20246 min read

Anastasiya NovikavaApr 27, 20235 min read

Steps to conduct a third-party risk assessment

Assessments must be comprehensive. And they should focus on risks that matter. Vendor risk assessments that consider outdated or irrelevant issues are useless. So how can you carry out effective supplier assessments?

1. Decide the scope of the risk assessment

Start by creating a risk assessment team. Bring in expertise from different areas of the company. Broader expertise will help identify relevant risks that compliance teams might miss. Executive support is also critical to managing third-party risk across the enterprise.

Determine what forms an acceptable level of risk. Some third-party risk is unavoidable. Assessment teams should be clear about identifying risks that need action and monitoring.

2. Document third parties and identify critical risks

The second step in the assessment process is inventorying current third parties. Document all partners and create separate vendor risk assessments for each one.

Next, decide which risks apply to each supplier. The following questions are helpful when understanding vendor risk levels:

Does the supplier have access to internal networks and company data?

Are there specific regulatory risks associated with the supplier? For example, HIPAA compliance.

What security controls against cybersecurity threats does the third party operate?

Does the supplier have an incident response plan and a risk management program?

What certifications does the supplier have?

What is the security record of the third party? Have they been subject to regulatory intervention?

Where is the third party located? Does location matter?

Are business partners likely to subcontract operations to other vendors?

At this stage, you may need to request information from third parties. Create a risk assessment form for suppliers that covers relevant areas. Or request information about security certifications if this is available.

3. Classify risks on a third-party risk matrix

The next stage involves assessing the severity of each vendor risk. The best way to do this is by using a matrix to generate risk scores.

A risk matrix generally includes two axes with five entries on each axis:

The X-axis grades the “impact” of an event and runs from “negligible” to “catastrophic”. Scores double from left to right.

The Y-axis assesses the likelihood of the event occurring. It runs from “extremely unlikely” to “extremely likely.” Again, scores double from bottom to top.

Scores rise as events become more likely and severe. For example, a CRM provider might steal customer data to sell on the Dark Web. We would class this risk as “unlikely”. But the consequences would be “severe” giving it a score of eight.

In another scenario a supplier fails to meet GDPR privacy standards. This would have a different score. In that case, the likelihood might be “likely” and the impact “major.” This results in a score of 12.

This system makes it easy to focus on the most urgent risks. And it also makes it easier to revisit risk assessments during risk audits.

Extra effort pays off in network security

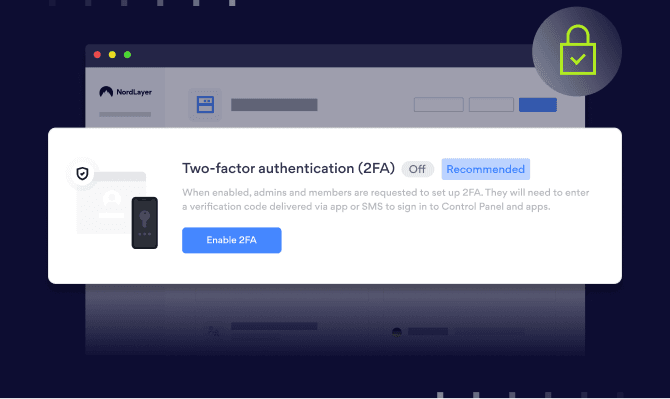

Use NordLayer's MFA for tighter third-party access control

4. Select third-party suppliers

Use risk classifications to grade potential or existing suppliers. Choose third parties that provide services according to your company strategy. But only pick partners with solid risk management practices.

With a robust risk assessment in place, you should be able to choose reliable and secure partners. Security teams will also know how to put in place controls to mitigate third-party risks.

5. Put in place continuous risk assessment

Risk assessment does not end when controls and smooth relationships are in place. Third-party risk assessment is a continuous process.

Revisit each third-party assessment on at least an annual basis. Check that the initial process identified critical risks. And make adjustments to reflect changes in the risk environment. For example, a supplier may have suffered a data breach. Or they may have started subcontracting services. Both changes could affect the supplier’s risk score.

Best practices for third-party risk assessment

1. Standardize risk assessments with a consistent template

Third-party risk assessments should be comparable. Companies must assess many suppliers. And they need the ability to pick a partner that meets their risk requirements.

Create standard risk assessment and questionnaire templates for each supplier. Document risk assessments. Create a risk framework that enables informed decision-making when onboarding external partners.

2. Understand the core risks your business faces

Not all risks are equal. Focus on critical risks. These risks can damage your company’s operational, compliance, and security posture.

Risks vary between sectors. Healthcare companies must follow HIPAA guidelines. Merchants need a robust PCI-DSS compliance framework. Select the risks that suit your business profile.

3. Classify vendors according to their importance

Vendors carry different amounts of risk. For instance, food delivery services are less critical than partners hosting financial data. Clarify the most important external relationships. Make them a priority when carrying out third-party risk management.

4. Assign resources for third-party research

Third-party risk assessments should identify the strengths and weaknesses of suppliers. Research vendor security processes, compliance histories, and client support services.

5. Build risk into watertight vendor contracts

Risk assessments should feed into third-party contracts or Business Associate agreements. Make sure contracts include core compliance requirements. State areas of responsibility for external partners. Track contracts as part of ongoing vendor risk assessment.

6. Schedule risk audits for all suppliers

Risk assessments should be dynamic. Revisit each supplier assessment annually and check that previous risk classifications remain relevant. Assess data security issues, including any data breaches. Ensure suppliers are compliant with any new regulations. And assess new risks that arise as regulations change.

7. Focus on disaster recovery

When assessing third parties, always request information about their incident recovery processes. Find partners that cut downtime and restore services without compromising security.

8. Always have a vendor exit strategy

Onboarding vendors is only half the challenge. Companies should always change suppliers that fail to meet risk-based requirements. Set a minimum service level and include this in vendor contracts. And enforce this policy to avoid using non-compliant partners.

Secure third-party access with enterprise browsers

Enterprise browsers are emerging as a valuable solution in third-party risk management. These controlled environments allow external vendors to access specific web applications while minimizing exposure to sensitive assets.

An enterprise browser can enforce corporate policies, isolate vendor sessions, and prevent unauthorized data movement—all without requiring deep network integration. By using a secure browser, companies can reduce compliance risks and support efficient vendor risk assessments without sacrificing usability or control.

How can NordLayer help?

NordLayer's security products help reduce supply chain risk. IP allowlisting enables access for verified partners while blocking unknown identities. Users can apply multi-factor authentication (MFA). This ensures that internal employees and third-party vendors verify their identities.

Business Browser—coming soon from NordLayer—takes this a step further. It creates a secure, managed environment for external users to access web apps and SaaS tools. IT teams can enforce granular olicies, monitor activity, and reduce the risk of data leaks or policy violations—wthout extending full network access. It’s a powerful tool for managing third-party risks in remote and hybrid work setups.

Network segmentation also allows organizations to protect confidential data and critical applications. Attackers targeting your supply chain may manage to gain network access. But NordLayer's micro-segmentation tools restrict their ability to move between assets. As a result, the scope to extract data and damage systems is much lower.

Contact us today and learn how NordLayer's solutions can supplement your vendor risk management strategy, and be among the first to try NordLayer’s Business Browser—join the waitlist now.

Agnė Srėbaliūtė

Senior Creative Copywriter

Agne is a writer with over 15 years of experience in PR, SEO, and creative writing. With a love for playing with words and meanings, she crafts content that’s clear and distinctive. Agne balances her passion for language and tech with hiking adventures in nature—a space that recharges her.